MP Materials Stock: The Next Nvidia? Gimme a Break...

GENERATED TITLE: MP Materials: The Next Nvidia, or Just Another Mining Company?

Alright, so the hype machine is cranked up to eleven again. MP Materials, huh? "The next Nvidia"? Give me a break. Every time a stock shows a pulse, some genius analyst slaps a ridiculous comparison on it to grab headlines. I swear, it's like they're allergic to original thought.

Rare Earths: Rare Profits?

Okay, the basic story is this: MP Materials mines rare-earth metals, which are apparently essential for everything from smartphones to electric vehicles. They've got this mine in California, see, which makes them a "critical component of today's world." That's the pitch, anyway. And yeah, the stock's up 250% this year. So what? Plenty of dog turds have a good year on Wall Street.

The comparison to Nvidia is especially laughable. Nvidia makes high-margin chips that are practically required for AI development. MP Materials digs stuff out of the ground. One's a tech company riding a tidal wave of innovation; the other is a mining company exposed to commodity price swings and heavy capital expenditures. See the difference? It's like comparing a racehorse to a donkey.

And let's talk about that "scarcity" argument. Sure, MP's Mountain Pass mine is one of the only scaled sources of rare earths in the US. But China controls the damn market! That's not scarcity; that's dependence with extra steps. The Trump administration threw $400 million at them, hoping to break free from Chinese imports. Good luck with that. Throwing money at a problem doesn't magically solve it.

The Magnet Mirage

Morgan Stanley is out there saying MP Materials is "developing a fully domestic rare earth mine-to-magnet supply chain." Oh, really? And the tooth fairy is leaving stock tips under my pillow tonight. They're planning to start commercial production of permanent magnets by the end of 2025, which sounds great...if they can actually pull it off. "Project execution is the biggest risk now," says some analyst. You think? Is MP Materials stock worth owning amid rare earth volatility? MS weighs in By Investing.com

They're building a second magnet factory (the "10X Facility," because everything needs a catchy name these days). When that's done, revenue's supposed to "soar." Maybe. Or maybe it'll be another boondoggle that enriches the executives while leaving investors holding the bag. Who knows?

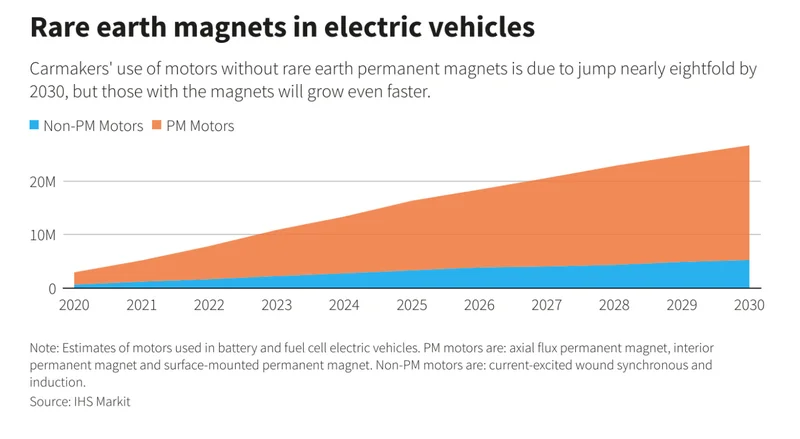

Here's a thought: If the future is all EVs and wind turbines, and those things need rare earth magnets, and MP Materials is sitting on a pile of the stuff, then shouldn't they be printing money?

Instead, they're unprofitable. They're trading at a forward 12-month price/sales multiple of 16.67X, which is apparently a "significant premium" to the industry. Translation: They're wildly overvalued.

The Zacks Consensus Estimate for 2025 earnings is a loss of 23 cents per share. But hey, 2026 is gonna be great! They're projecting earnings of 92 cents per share then. Projections, projections...it's all just smoke and mirrors until the actual numbers come out.

And get this: MP Materials has "premium partnerships with Apple and the DoD." Sounds impressive, right? Except Apple is notorious for squeezing its suppliers dry, and the DoD...well, let's just say government contracts aren't exactly a guaranteed path to riches.

Can't Polish a Turd

So, should you buy MP Materials stock? Analysts are all over the place, naturally. Some say "hold," some say "wait for a better entry point." I say, maybe take a long, hard look in the mirror and ask yourself if you're really comfortable betting your hard-earned money on a mining company with a shaky business model and a pie-in-the-sky valuation.

I mean, this article from Zacks concludes with this gem: "Investors holding MP shares should continue to do so to benefit from the solid long-term fundamentals of rare earth products." That's it? That's the big insight? Thanks for nothing.

So, What's the Real Story?

Look, I'm not saying MP Materials is a complete scam. But the "next Nvidia"? That's pure, unadulterated hype. It's a mining company, for chrissake. They dig stuff out of the ground, and they're at the mercy of commodity prices and geopolitical forces beyond their control. Don't let the shiny marketing fool you.