VIX Slumps: What Happened?

Alright, let's get this straight. "Extreme fear" in the market? Give me a freakin' break. It's always "extreme fear" or "irrational exuberance." Never just, you know, normal levels of uncertainty.

The Fear Feedback Loop

So, the S&P 500 ETF (SPY) and Nasdaq 100 ETF (QQQ) both tanked over 1.5% because... wait for it... economic data is delayed. Delayed! Not bad, not good, just delayed. And suddenly, everyone's running around like Chicken Little.

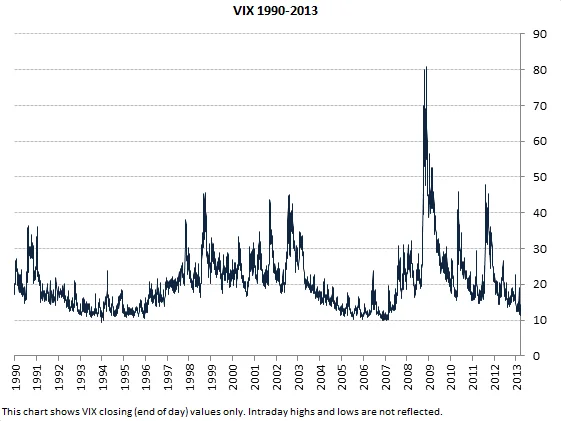

The Volatility Index (VIX) jumps 15%. CNN’s Fear and Greed Index plunges into "extreme fear." It's like these things are designed to trigger each other. VIX goes up, headlines scream "fear," algorithms start dumping stocks, VIX goes up even more... a self-fulfilling prophecy if I ever saw one. According to Stock Market News Review: SPY, QQQ Slump on Economic Data Disruption as VIX Surges 15%, the SPY and QQQ slumped due to economic data disruption.

And the White House is out here saying the Democrats may have "permanently damaged the federal statistical system.” Seriously? Blaming political opponents for delayed data? That's rich, comin' from those guys.

Rate Cut Roulette

Then there's the Fed. Oh, the Fed. Always the scapegoat, always the puppet master. Now, apparently, several Fed officials are worried about inflation. Inflation, which, last I checked, was at 3%. Three percent! Is that supposed to be some kind of economic apocalypse?

Wall Street Journal's Nick Timiraos points out that four Fed presidents aren't "actively agitating" for a December rate cut. Translation: they're covering their asses because nobody knows what the hell is going on.

The odds of a rate cut are now a coin flip. 51.9%. Down from almost 70% a week ago. It's all just a big casino, and we're all forced to play.

But wait, there's more! The Fed also has to worry about "maximum employment." Because, offcourse, they actually care about that. Last week, some firm called Challenger, Gray & Christmas reported 153,074 job cuts in October. Highest since 2003. So, lower rates are good for jobs, but bad for inflation. Higher rates are good for inflation, but bad for jobs. It's a lose-lose situation, and the Fed is stuck playing whack-a-mole with the economy.

You know what else is frustrating? I tried to check out what TelevisaUnivision had to say about all this, but their website is blocked in my region. Apparently, I'm not worthy of their financial insights. How convenient.

The Illusion of Control

Here's the thing: nobody actually knows what's going to happen. Not the Fed, not the analysts, not even that dude on CNBC with the crazy hair. They're all just guessing, and we're all pretending like they have some kind of magical insight.

It's all just one big performance, a carefully constructed illusion of control. And we're the audience, paying for the privilege of being lied to.

It's All a Rigged Game

Look, maybe I'm being too cynical. Maybe there is some grand economic plan at play, some genius strategy that will save us all. But honestly, I doubt it. It feels like everyone's just making it up as they go along, and we're all just along for the ride. A bumpy, terrifying, anxiety-inducing ride, where the only certainty is that someone, somewhere, is making a killing off our fear.